When is refinancing worth it? How much should your rate drop?

Erik J. MartinThe Mortgage Reports Contributor

April 14, 2022 - 12 min read

Is refinancing worth it right now?

Refinancing is usually worth it if you can lower your interest rate enough to save money month-to-month and in the long term. Depending on your current loan, dropping your rate by 1%, 0.5%, or even 0.25% could be enough to make refinancing worth it.

This means that even in a rising-rate environment, a refinance is still worthwhile for some homeowners.

If you think you could get even a slightly lower rate, check to see if a refinance is worth it based on your new rate and savings.

In this article (Skip to...)

>Related: 7 Tips to get the best refinance rate

Is it worth refinancing for 1 percent?

As a rule of thumb refinancing to save one percent is often worth it. One percentage point is a significant rate drop, and it should generate meaningful monthly savings in most cases.

For example, dropping your rate a percent — from 3.75% to 2.75% — could save you $250 per month on a $250,000 loan. That’s nearly a 20% reduction in your monthly mortgage payment.

Those monthly savings can be put toward daily living expenses, emergency funds, investments, or paid back into your mortgage to pay the loan off early and save you even more money in interest.

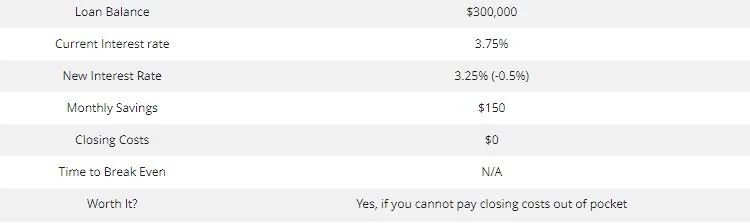

Refinancing for a 1 percent lower rate

Here’s an example when refinancing is worth the expense.

Keep in mind, “breaking even” with your closing costs isn’t the only way to determine if a refinance is worth it.

A homeowner who plans to move or refinance again before the break-even point might opt for either:

1. No-closing-cost refinancing

A no-closing-cost refi typically means the lender covers part or all of your closing costs, and you pay a slightly higher interest rate in exchange.

Accepting this higher rate will eat into your monthly savings. But if you’re still saving enough when compared to your existing mortgage loan, this strategy can still pay off.

You’d be avoiding closing costs and still saving money month to month, so you wouldn’t have a break-even point to worry about.

This is often a win-win situation for borrowers who plan to keep their new loan for only a few years.

2. Rolling the closing costs in your new loan

Rolling closing costs into the refinance loan will increase your principal balance and total interest paid. But if you’re going to keep the loan for more than a few years, rolling closing costs into the loan amount may be more affordable than accepting a no-closing-cost loan with a higher interest rate.

“Most borrowers choose the latter— lumping the closing costs into the loan so they can receive the lowest possible rate. But that’s not always the best option unless you plan to stay in your home for at least several years,” says says Tom Furey, co-founder of Neat Capital.

Is it worth refinancing for 0.5 percent?

There are two common scenarios when refinancing for half a percent could be worth it:

1. Refinancing for 0.5 percent: Break-even method

First, let’s look at a break-even scenario.

Remember, the less your rate drops, the less you save each month. So it takes longer to recoup your closing costs and start seeing “real” benefits.

That’s a decent monthly savings, but it will likely take you over three years to break even with closing costs. So you want to be sure you’ll keep the refinanced loan for at least that long.

Now let’s look at how the numbers compare if you can drop your mortgage interest rate by 0.5% using a no-closing-cost refinance.

2. Refinancing for 0.5 percent: no-closing-cost method

Say your current mortgage rate is 3.75%. Your refinance lender offers you a new rate of 2.5%.

“A thing to note here: While this isn’t true of all loan officers, most tend to quote ‘no cost refis’ as often as possible. So if you can save 0.5% in this case, it’s a great deal,” adds Meyer.

Of course, you would save a lot more money both month-to-month and in the long run if you accepted the lower mortgage rate and paid closing costs upfront.

Those who can easily pay the closing costs out of pocket should typically do so.

But for homeowners without a lot of savings, it might make sense to accept the higher, no-cost rate. This could allow you to refinance and see month-to-month savings without having to worry about the initial cost barrier.

Is it worth refinancing for just 0.25 percent?

As a rule of thumb, experts often say refinancing isn’t worth it unless you drop your interest rate by at least 0.5% to 1%. But that may not be true for everyone.

Refinancing for a 0.25% lower rate could be worth it if:

You are switching from an adjustable-rate mortgage to a fixed-rate mortgage

You have a large loan balance

You can refinance to consolidate high-interest debts

You are leveraging home equity with a cash-out refinance

You have a jumbo loan with significantly higher interest rates

1. Refinancing into a fixed-rate loan

“Say you are refinancing from an adjustable rate to a 0.25% lower fixed rate. Here, refinancing may make sense. That’s especially true if you expect interest rates to increase,” says Bruce Ailion, Realtor and property attorney.

2. Refinancing a large loan amount

A quarter-point rate drop may also benefit someone with a large principal borrowed.

“A large loan size may result in significant monthly savings for a borrower, even when rates dip by only 0.25%,” says David Reischer, attorney and CEO of LegalAdvice.com.

To illustrate this point, consider the following example from Steven Ho, senior loan officer at Quontic Bank:

Assume you have a $500,000 mortgage at a 4.5% rate

Your monthly principal and interest payment is $2,533, with a PMI payment of $250

So your total monthly payment is $2,783

You opt to refinance to a 4.25% rate (0.25% lower than your initial rate)

This would reduce your monthly payment to $2,459 — saving you $324 per month

“Over five years, that adds up to over $19,000 in savings,” Ho notes.

Even if you pay 2% in closing costs on that $500,000 loan, your upfront cost is just $10,000. So you save almost twice as much as you spent on the refinance within the first five years.

3. Refinancing to consolidate debt

Refinancing for 0.25% might also make sense in the case of a debt consolidation refinance.

“Imagine you have $20,000 in credit card debt. The interest on this credit card is 25%, which adds up to paying $416 a month just in interest,” Ho says.

Say your original mortgage balance was $500,000 at a 4.5% fixed rate, equating to a $2,533 monthly mortgage payment. But you decide to roll your $20,000 in credit card debt into your mortgage refi.

You’ll now have a $520,000 mortgage balance and a higher monthly payment of $2,558 after refinancing to a 4.25% rate.

“Your mortgage payments go up $28 extra a month. But your overall savings would be $391 a month. That’s because you’re no longer paying 25% interest on the credit card debt,” adds Ho.

4. Cash-out refinance and home improvement loans

Say you plan to take cash out during your refinance. Then, the decision to lower your rate by 0.25% via a refi gets more complicated.

“With a cash-out refi, your monthly mortgage payment may not go down,” says Reischer.

“But you can use the cash taken out to consolidate other higher paying debt obligations. Or it can be used to make needed home improvements. That can be a very good reason to do a cash-out refi — to make upgrades that will increase the value of your property.”

Also, think about refinancing to a shorter mortgage term — like from a 30-year mortgage to a 15-year loan with a fixed rate.

“This can yield even lower refinance rates. And it can result in you paying less in interest payments over the life of your loan,” says Ailion.