LOANS > QUICKEN LOANS REVIEW

Quicken Loans Review

Quicken Loans offers a world class customer experience and a completely online application process through Rocket Mortgage.

By Tim Fries Reviewed by Shane Neagle

Looking to rush into a mortgage?

Maybe you just want to get the process over with, land yourself with inflexible rates and terms, and have no support to help you out if things become unmanageable.

We doubt it.

A mortgage is one of the biggest and most significant loans many of us will take out in our lifetime. With the effects of COVID-19 continuing to deepen, our ability to repay debt is being profoundly impacted, and mortgages are no exception.

In fact, mortgages are the single largest source of debt for homeowners, and have the biggest impact on our finances through wage decreases or job losses.

Additionally, with more conventional banks pulling back from the $11 trillion US mortgage market (due to the lack of profit opportunities and stricter regulation post financial crisis), more independent, but potentially riskier, mortgage companies are flooding in.

As such, knowing what to look out for in your mortgage and mortgage lender will be crucial to helping you stay above the water throughout the pandemic — and far beyond (which can’t come soon enough). Will Quicken Loans provide adequate support throughout the process? Could it offer you the terms and flexibility needed during such financially uncertain times? Or will its rates be just too much to manage?

In this review, we outline why Quicken Loans is known for offering a world class customer experience, its loan types and terms, and what you can expect to pay.

Ready? Let’s get to it.

What is Quicken Loans?

Quicken Loans Mortgage Service (QLMS) is an online lender based in Detroit. Since its founding in 1985, the lender has grown to become the most recognizable brand in retail mortgage lending in the U.S., as well as its ever-present online mortgage lending platform.

Our research shows that Quicken Loans is considered one of the top mortgage lenders you can find, for a number of reasons. Sit tight and we will go through exactly why.

Quicken Loans offers a wide variety of mortgage types. But as opposed to going into a building to complete that often arduous task of application signing, this lender embraces technology to enable clients to complete the entire process online.

In 2016, Rocket Mortgage was born; Quicken Loans fully online mortgage lending platform. Rocket Mortgage is more widely known, largely because of its TV coverage. Recently, Quicken Loans announced it would undergo a total rebranding with the aim of closer aligning itself with the globally recognized brand.

Quicken Loans has a Better Business Bureau (BBB) rating of “A”. The company has been BBB accredited since 1986.

Quicken Loans Rebrands to Rocket Pro TPO

Shortly after going public, Rocket Companies’ broker channel, Quicken Loans, sent waves through the industry when it announced it would rebrand to Rocket Pro TPO in an effort to closer align itself with Rocket Mortgage.

When questioned about the catalyst for the decision, Quicken Loans’ Austin Niemiec said,

“QLMS has always been focused on providing exceptional pricing, products and technology to our partners. It has made us a lot of fans – more than 40,000 of them are partner LOs right now. We have been listening closely to our partners and their feedback. Through that research, we learned there were three areas where they are clamoring for advancement with every lender they partner with: more technology, marketing and better access to leads. Thanks to the rebrand and leaning more into Rocket, we are able to give brokers exactly what they are asking for.”

Revitalizing Communities

Quicken Loans has helped advocate for minority voices in its base town of Detroit – a lower class majority black community. The lender boosted a project to transform the struggling city into a thriving metropolis.

Overview & Summary

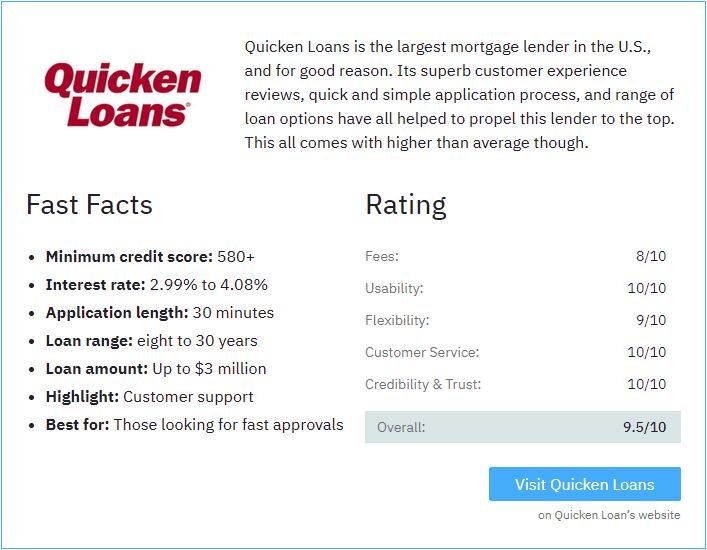

There is much to take into consideration when it comes to finding the right mortgage lender. Here is a round up of some of Quicken Loans’ key points.

Quicken Loans is an online lender based in Detroit, and the largest mortgage lender in the US.

Quicken Loans offers a range of loans including conventional, FHA, VA, and USDA loans, in addition to refinancing.

Quicken Loans has rates starting from 2.99%, and charges origination fees, closing fees, and rate-rock fees.

Benefits of Quicken Loans include its refinance calculator, world class customer service team, and Rate Shield, which locks in interest rates for 90 days.

Areas this lender could improve are that it does not offer home equity loans or HELOCs, it has limited down payment eligibility, and there are no physical branches.

Are Quicken Loans & Rocket Mortgage the Same Company?

Quicken Loans and Rocket Mortgage are a part of the same conglomerate, but they both have different purposes. Rocket Mortgage is the technology platform that Quicken Loans uses to process mortgage payments and the application process.

Quicken then deals with all the behind the scenes aspects, like underwriting. Both Quicken Loans and Rocket Mortgage have the same criteria and requirements for their loans, as well as the same rates. So don’t waste your time applying to both.

Quicken Loans offers one of the broadest ranges of mortgages including fixed, and adjustable loans, VA, FHA, and USDA loans, jumbo and refinance loans.

Home shoppers can lock in their interest rate for a total of 90 days once approval is granted for the purchase loan through Quicken Loans’ RateShield Approval.

Helpful tip: Are you worried that a low credit score is holding you back from a low interest rate? We recommend taking a lot at the pros and cons of Sky Blue Credit Repair. They offer a simple, yet quality service at a reasonable rate.

Quicken Loans Mortgages

Quicken Loans offers a broad range of mortgage options. Let’s take a more detailed looked at Quicken Loans loan options:

Conventional Mortgages

These are loans accessible to borrowers for either purchase or refinance, but you will generally need better credit than the other loan programs offered. As you may have already noticed, credit scores have a huge impact on your financial future.

With this loan, properties can be bought or refinanced as a primary residence, investment property, or vacation home. The majority of the time, a minimum downpayment of 5% will be required.

FHA Mortgages

These are government-backed loans that borrowers with less than excellent credit can access. FHA mortgages are given to owner-occupied primary residences, for purchase or refinance only, and generally require a minimum downpayment of 3.5%.

VA Mortgages

Va mortgages can be applied for by eligible veterans and active duty military personnel, to purchase or refinance a primary residence only. A key benefit of VA loans is that they offer 100% financing. These are also slightly more flexible on credit than conventional mortgages.

Jumbo Mortgages

Each mortgage type already mentioned has defined limits: up to $484,350 for single family properties, or up to $729,525 in designated high-cost areas. The Jumbo mortgage, on the other hand, is available for much larger amounts – as the name implies. That said, these typically require larger down payments, as well as better credit scores.

If you really need to access a jumbo mortgage, but don’t have the credit needed, learning a few simple steps to build credit can help you along the way.

USDA Loans

USDA loans aren’t too dissimilar to VA loans in that they offer 100% financing on owner-occupied homes. But USDA loans are specifically for lower income earners, and usually for lower amounts.

If you are in a rural or lower-population area, get to know what a USDA loan is, how it works and how it compares to other mortgages.

Minimum Credit Score for a Quicken Loans Mortgage

If you don’t already know what a good credit score is, then make sure you read up on it first. Here are the minimum credit score requirements that you will need to apply for a loan with Quicken Loans:

620 for conventional and (typically) for VA loans

580 for FHA loans

760 for jumbo loans on purchases, and 700 for refinances

Minimum Borrower Requirements

FICO scores aren’t the only thing that Quicken Loans takes into consideration. Quicken Loan follows the loan requirements for mortgages approved by government-sponsored enterprises (GSEs), Fannie Mae and Freddie Mac, as well as those backed by the Federal Housing Administration (FHA) and the Department of Veterans Affairs (VA).

Conventional loans have a key requirement of a minimum FICO score of 620+, and a minimum down payment of 3%. However, if you pay less than a 20% downpayment the private mortgage insurance (PMI) requirement will be triggered.

Borrowers will need a debt-to-income ratio (DTI) of 50% or less, coupled with 2% to 6% of the purchase price in cash reserves to balance out the closing costs.

For FHA, VA and USDA loans, those requirements are set by the government. You can find them here:

Quicken Loans Interest Rates

Quicken Loans mortgage rates are typically higher than the market average. Here’s a breakdown of fees:

Quicken Loans Closing Costs and Fees

Lender Fees

Quicken Loan charges origination fees, closing fees, and rate-rock fees. Each one varies by taxes and loan type. Quicken Loan’s website states that closing costs average between 2% to 6% of the purchase price.

For example, were you to take out a loan of 250,000, at the lower rate of 2%, you would pay $5,000 in closing costs. Closing costs include things like appraisal fees, recording fees, title fees, taxes, pest inspection, survey fees, and attorney’s fees.

Accessing the lower end of these closing costs will require you to have an excellent credit score, and it could make all the difference to making your repayments manageable. If yours isn’t high enough to get the best rates, there are particular mortgages for borrowers with bad credit — some might be easier to obtain than you think. If you have bad credit, perhaps this is your ticket to an optimized rate.

How Fast Can Quicken Loans Close?

Quicken Loans can close your home in one day, and within one hour at the final closing. During this time, you will be asked to sign the closing documents and pay your closing costs and down payment. Here are some time frames for closing:

Quicken Loans Application Process

Applying for a mortgage with Quicken Loans is fully online. But, you will notice that you will be redirected straight over to the Rocket Mortgage platform. That’s because Rocket Mortgage is a part of the same organization. You’ll also be asked if you would like to transfer to the Rocket Mortgage site.

1. Create your Account

When you go through the application, you will be asked to provide some standard information required by mortgage lenders. To start, you will need to create an account and then fill in some more information.

You’ll begin the process by giving the address of the property you hope to buy. For refinancing, you will just need to give your current address. More details for this property will be automatically pulled from the website.

This is a key benefit of Quicken Loans, and to applying for a mortgage from an online platform who are dedicated to using technology to provide a quality experience. The lender accesses third-party sources to collect the information needed to make the process easier.

2. Provide Personal Details

You will be asked for some personal information, including your Social Security number, or if there will be several names on the loan, you will need to include each person’s Social Security number.

This enables Quicken Loans to run a credit report, and calculate a rate that takes into consideration your credit score and the specifics of the property.

3. Your Rate Will Be Locked Down

The rate that Quicken Loans gives at this stage will be the actual rate subject to verification. If you decide that you want to continue, you will be asked to pay a fee of between $400 to $750, and the next step will be verification.

4. Your Information Will Be Verified

Although Quicken Loans differentiates itself from the mortgage lending crowd by being 100% online, it is similar in the supplying of documentation.

For this step, you will need to provide supporting documents. The advantage of Quicken Loans is that it can all be uploaded to the website, as opposed to going through the hassle of mailing hard copies. You might even already have these documents on your computer, which will make everything that little bit easier.

Quicken loans will verify your information through online sources, where possible. This may include verifying your income, employment, and bank account information. The more thorough and specific you are with your information, like account number, the easier it will be for Quicken Loans to do this.

On the other hand, if some information is not available online, you might be asked to supply the following:

Recent pay stubs

Income tax returns, if you’re self-employed, on commission, or have rental property

W-2s for the past two years

Copies of recent statements for bank accounts, as well as brokerage and retirement accounts

Proof of earnest money funds deposited on the new home

Documentation of Social Security or pension income

Copy of your divorce decree, if you either pay or receive child support or alimony

Copy of the purchase contract on the home you’re buying

Any other documentation required by Quicken Loans

Once the relevant information has been supplied, it will all be reviewed. If more information is needed, you will need to provide it. When your loan is approved, you will receive a pre-approval letter from Quicken Loans.

Refinancing with Quicken Loans

Quicken Loans mortgage refinancing are a good option if you want:

To refinance a jumbo loan to take cash out

To lower the rate on an FHA loan

A non-standard (or custom) repayment term

When you refinance your home, you already have a good idea of the mortgage process. This means that when it comes to refinancing, you can focus on finding the best rates and terms.

Quicken Loans makes the refinancing process simple, and offers a broad range of refinancing options, including FHA Streamline Refinance loans, conventional refinancing, and cash-out jumbo loan refinancing.

FHA Streamline Refinance

If currently have an FHA with an unfavourable interest rate, you could benefit from an FHA Streamline Refinance. This will allow you to adjust your terms and interest rate to correlate with today’s rates. In most cases, you will be able to refinance even if you owe more than the value of your home, without having to pay for a new appraisal.

These loans were created to allow homeowners to benefit from lower interest rates. They were not created to take cash out of your homes. If you prefer to take out $500 or more in cash when refinancing, you might be better off with a conventional or jumbo cash-out refinance.

Cash-out Jumbo Refinance

Homeowners looking to refinance jumbo mortgages with Quicken Loans could get up to $750,000 cash back. This will depend on the amount of equity on the borrower’s home.

Unsure what your home equity is? It’s the difference between how much your home is worth, and how much is left on your mortgage. For example, if you have a $500,000 jumbo mortgage, and your home is worth $700,000, you have $3000,000 in equity or an equity stake of 25%.

Quick note: Lenders generally want to maintain a 15% to 25% equity stage in your home if you want to take cash out when refinancing.

YOURgage: Customize Your Repayment Term

This option offers the ability to customize your repayment term to match your needs. This is unique in that many lenders only offer standard repayment terms.

If you have already been repaying a 30-year mortgage for 8 years, you may not want to refinance into another 30 years mortgage because it might cost thousands in additional interest. It also might be against your interest to repay the higher monthly payments that come with a 15-year mortgage.

Quicken Loans’ YOURgage mortgage gives you the freedom to choose a custom repayment term from eight to 29 years.

This mortgage is available for fixed-rate conforming mortgages of up to $484,350. It gives you the option to refinance up to 97% of the value of your home.

Is it Worth Refinancing for 0.5%?

Many experts agree that refinancing is not worth it unless your interest rate falls by at least 0.50% to 1%. However, this might not be exactly true in all cases.

Bruce Ailion, Realtor and property attorney said,

“Say you are refinancing from an adjustable rate to a 0.25 percent lower fixed rate. Here, refinancing may make sense. That’s especially true if you expect interest rates to increase.”

Quicken Loans Refinance Rates

Quicken Loans does have a refinance calculator on its website. Though, generally speaking, you should be prepared to pay 2% to 3% of your loan balance on closing costs.

You may be able to roll these costs into your loan balance, depending on the loan terms.

For example, someone taking out a mortgage of $250,000, this will roughly come to $5,000 if you get the lower end of the scale.

How Do Quicken Loans Payments Work?

Quicken Loans offers borrowers several ways to pay. Here are your payment options:

Online: Sign into your account – or create one if you haven’t done so yet – and go to Make a Payment.

If you see that your account isn’t yet eligible for online payments, you can call an Account Advisor at (800) 508-0944, option 4, Monday – Friday, 8:30 a.m. – 9:00 p.m. ET, or Saturday, 9:00 a.m. – 4:00 p.m. ET.

Nothing has changed for those with automatic or autopay set up. You can still freely cancel, edit, or change payments, as you wish, in the Payment Center.

Phone: You can call Rocket Mortgage at 800-646-2133 and make an automated phone payment using your loan number, bank account number, and bank routing number.

Mail: You can mail your payment to the following address:

Quicken Loans

P.O. Box 6577

Carol Stream, IL 60197-6577