(Getty Images)

Is My Home in a Flood Zone? How To Check Flood Maps and More To Stay Safe

Mar 26, 2022

EnvelopeFacebookTwitterLinkedinPinterest

Ahome’s risk of flooding—from hurricanes or a huge downpour—is probably not the first thing you’d think to check. However, the fact is that many U.S. homes lie within flood zones, so it’s essential to size up this potential and take precautions if necessary—well before you might end up underwater.

Most homes in high-risk flood zones are near a body of water. For instance, the Gulf Coast is one of the U.S. regions most vulnerable to hurricanes that cause flooding. Yet more than 20% of flood-related home insurance claims happen in non-flood zones, so no one should assume they’re safe.

And due to climate changes, flooding may also become more common. According to Popular Science, “Nearly 15 million American properties are at substantial risk of flooding in the next 30 years, and more than three million are almost certain to be underwater at some point in that time.”

So how can you find out if your home is in a flood zone—and if it is, how can you assess the size of this risk and what protections can you put in place? Whether you own a home or are looking to buy, here’s how to figure that out.

How to find out if a home is in a flood zone

There are a few ways to determine a home’s flood hazard status. One good starting point is the Realtor.com flood risk tool, a one-stop portal highlighting two distinct flood risk ratings for a property.

The Realtor.com flood zone mapping tool helps homebuyers assess a property’s flood risk. (Realtor.com)

The Realtor.com flood risk tool connects you directly to the Federal Emergency Management Agency site, where you can enter a property’s address and view a map showing flood zones in the area.

A sample flood zone map from FEMA (FEMA)

FEMA has a little over a dozen flood zone classifications, based on the estimated frequency of storms that could cause flooding in an area. High-risk zones are known as a Special Flood Hazard Area. According to FEMA, SFHAs have a 1% annual chance of flooding, “also referred to as the base flood or 100-year flood.”

Moderate flood zones are labeled with a B or X, and reflect a 0.2 % annual chance of a flood (also considered a 500-year flood). The areas with the lowest chance of flooding are labeled with a C or X. These areas are outside the SFHA zones and are at higher elevations.

Beyond FEMA flood maps: Other flood risk tools to check

While FEMA flood maps are a trusted government resource on flooding, one downside is that many of their maps are decades old—meaning you may not be getting the most current snapshot of a home’s flood risk. So while FEMA data is used to determine insurance risk and building code requirements‚ they do not necessarily calculate the likelihood that a property might flood in the future.

(FEMA is currently overhauling how it calculates flood risk to “adapt and re-adjust rates based on a changing, unpredictable climate,” with changes slated to be unveiled in late 2021.)

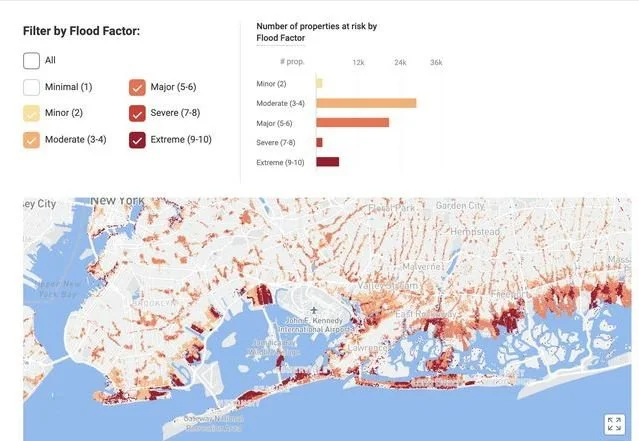

To shore up this shortcoming, the Realtor.com flood risk tool also features data from Flood Factor, created by the nonprofit First Street Foundation. While Flood Factor works in conjuncture with FEMA, this tool uses more current data based on changing climate conditions to forecast a particular home’s probability of flooding in the future.

A flood risk map showing an area’s risk of flooding in the future (FloodFactor)

While FEMA maps and Flood Factor ratings can certainly help you get a sense of a property’s flood risk, you should know that these numbers are only a start, and are by no means a crystal ball showing you a property’s future risk of flooding with 100% certainty.

Aside from flood maps, other resources to check include tax record databases and title searches, both of which should indicate a property’s flood risk.

“You can also ask your home insurance agent,” says real estate agent and attorney Bruce Ailion, of Atlanta’s Re/Max Town and Country.

Is a property’s flood zone status disclosed to home shoppers?

While all states have laws regarding property disclosure, the specific laws regarding FEMA flood zone status vary from state to state, says Johnny Harper, owner of J and J Home Inspections in Nashville, TN.

Federal laws don’t require disclosure of previous flooding. But in states such as New York, sellers are required by law to disclose to a potential buyer whether the property is in a floodplain or has previously flooded.

However, regardless of state laws, “Full disclosure is certainly the ethical responsibility of the seller and the listing agent,” Harper says.

As a homebuyer, you should research the property and flood maps (or have your real estate agent check) to see if it’s in a flood hazard area. If you’re obtaining financing, the mortgage company will also investigate the most updated flood zoning as well.

“If the property is found to be in a flood zone, the mortgage company will require flood insurance,” says Adam D’Annunzio, a real estate agent with Keller Williams in New Jersey who sells real estate in flood zones such as the Jersey Shore.

Do you need flood insurance, plus how much does it cost?

Did you know that most home insurance policies don’t cover damage or other losses caused by flooding? Homes in high-risk areas are typically required to purchase additional flood insurance.

The federal government offers subsidized flood insurance to property owners through the National Flood Insurance Program. The average cost of flood insurance through the NFIP is $734 per year.

Of course, the amount you pay will vary based on your property’s flood risk and where you are in the floodplain, as specified on the flood insurance rate map.

If you are in a high flood-hazard zone, Harper says flood insurance can be significantly more expensive. For instance, Vermont is the state with the highest average flood insurance, at $1,512 per year.

Flood insurance costs will also depend on the house, including factors like years of construction, number of floors, location of the lowest floor (in relation to the base flood elevation on a flood map), building occupancy, location of contents, and your deductible.

Does being in a flood zone affect a home’s price?

Whether you’re a seller or a buyer, keep in mind that a home’s price is likely to be affected if it is in a flood plain. Why? According to FEMA, “just one inch of floodwater can cause up to $25,000 in damage.”

“Sellers know the cost of yearly flood insurance could affect what buyers can afford,” says D’Annunzio. Sellers will probably take those extra expenses into account when pricing their home.

The property could also be seen by buyers as less desirable if the risk of damage from future flooding is high, so a highly motivated seller might list the home a bit lower as a result.

As a buyer, if you feel a home’s price is high related to its flood risk, this is certainly a negotiation point.

Do you need flood insurance outside flood-prone areas?

If you live in a moderate- to low-risk area within or just outside a floodplain, should you buy flood insurance?

Flood zones are based on an estimation of the number of storms that will cause flooding in a year, but there’s no guarantee that your area will flood. Still, you want to be covered in the event that something does happen. It’s worth noting that about two-thirds of properties that were flooded as a result of 2017’s Hurricane Harvey occurred at properties outside of the 100-year floodplain, according to the Harris County Flood Control District.

If you’re wavering between buying and not buying flood insurance, ask yourself this question: Do you think the possibility of flooding—and the damage associated with it—is worth the insurance premium?

In some cases, having flood insurance is worth the peace of mind and protection it offers. Also keep in mind when looking at the FEMA map that it’s possible that only part of your lot—and perhaps not your actual house—may be in the flood zone.

How to minimize your losses from flood

If your home is in or near a flood zone, Harper advises taking these steps:

Maintain proper grading, where the ground around your house slopes slightly downward to keep water seeping outward rather than in. In fact, a flood insurance policy typically won’t cover you if your house floods due to improper grading. A landscaper can remedy this problem by adding soil around your home’s foundation.

Elevate your furnace, water heater, and electric panels to protect them from possible floodwaters.

Keep storm drains and gutters free of debris, and install check valves (or one-way valves) to keep floodwater from backing into your drains.

Seal your basement walls with waterproofing materials.

Store your valuables and legal documents on your upper floors.